Editable Revocable Living Trust Template [PDF & Word]

Create a Revocable Living Trust template with ease with LegalSimpli. Secure your rights, streamline processes, and maximize your revenue efficiently.

Feel Safe with LegalSimpli

100% Secure

Enjoy peace of mind because LegalSimpli ensures all customer data is 100% secure.

Unlimited Cloud Storage

Keep your legal files secure and always accesible with LegalSimpli's unlimited document storage.

Customer Support

Experience top-tier costumer support with LegalSimpli, where your statisfaction is our top priority.

Revocable Living Trust Overview

A Revocable Living Trust is an estate planning tool that provides flexibility and control over your assets, allowing you to change or revoke the trust at any time during your lifetime. The legal document outlines the instructions for the management of your assets and property while you are alive and after your death.

A Revocable Living Trust provides many benefits, including avoiding probate, minimizing estate taxes, providing privacy, and ensuring that your assets are distributed according to your wishes. Creating a Revocable Living Trust is an important step in protecting your assets and ensuring that your loved ones are taken care of after your death. With a little research and effort, you can create a legally binding Revocable Living Trust that meets your needs and protects your assets.

Key Takeaways:

- Use a Revocable Living Trust to manage assets in a trust, controlled by you till death.

- A Revocable Living Trust can aid estate planning, probate avoidance, and minor care.

- Using a fillable Revocable Living Trust template can offer advantages such as cost savings, ease of use, and customization to your specific needs and situation.

Your Stories, Our Commitment

How our templates are helping users streamline legal matters

What is a Revocable Living Trust?

A Revocable Living Trust is a legal document that is designed to manage your assets while you are still alive and after you pass away. It is a flexible estate planning tool that allows you to make changes to the trust as your life circumstances change. The Revocable Living Trust is an alternative to a will as it allows you to avoid probate. The trust is called “living” because it is created during your lifetime, and it is “revocable” because you can make changes to it or even revoke it entirely if you wish.

The contents of a Revocable Living Trust typically include details about the assets that you transfer into the trust, as well as instructions for how those assets should be managed and distributed after your death. You can name yourself as the trustee of the trust, which means that you retain control over your assets while you are alive. You can also name a successor trustee who will take over management of the trust after you pass away. Some of the benefits of a Revocable Living Trust include greater control over your assets, privacy, and flexibility. Additionally, because the trust avoids probate, your beneficiaries can receive their inheritance more quickly and with less expense.

By taking the time to create a Revocable Living Trust, you can have peace of mind knowing that your assets will be distributed according to your wishes.

When Do I Need a Revocable Living Trust?

A Revocable Living Trust may be beneficial when:

- You want to avoid probate: A Revocable Living Trust can help your assets avoid probate, which is the legal process of validating a will. By doing so, you can save time and money, and ensure that your assets are distributed according to your wishes.

- You have minor children or dependents: If you have minor children or dependents, a Revocable Living Trust can help ensure that they are taken care of in the event of your death. You can name a trustee to manage the trust until your children are old enough to handle the assets themselves.

- You want privacy: Unlike a will, a Revocable Living Trust is not a public document. This means that your personal information and the contents of the trust will remain private.

- You have complex assets: If you have complex assets, such as multiple properties or businesses, a Revocable Living Trust can help ensure that they are managed properly and distributed according to your wishes.

- You want to plan for incapacity: A Revocable Living Trust can also be used to plan for incapacity. You can name a trustee to manage the trust if you become incapacitated and unable to manage your own affairs.

LegalSimpli’s Revocable Living Trust templates and you expensive collection of legal samples will help guide you through all of these scenarios and get your trust sorted fast.

How To Fill Out a Revocable Living Trust Using Our FREE Wizard Template?

Simplify the process of completing a Revocable Living Trust form

- 1Select your preferred format and color.

- 2Fill in the required information.

- 3Add or request electronic signatures.

- 4Download, print, or send your customized legal document.

Failure to transfer may require probate.

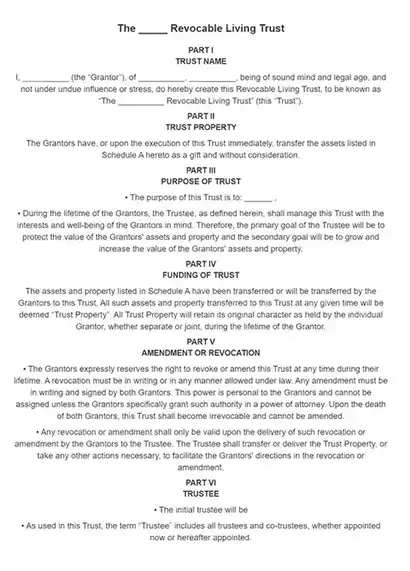

Components of a Revocable Living Trust

Here are all aspects you should cover in a Revocable Living Trust:

- Grantor: The person who creates the trust and transfers their assets into it.

- Trustee: The person or institution responsible for managing the trust assets. In a Revocable Living Trust, the grantor usually serves as the initial trustee.

- Beneficiaries: The individuals or organizations who will receive the trust assets upon the grantor’s death.

- Assets: The property and assets that are transferred into the trust, such as real estate, investments, and personal property.

- Terms: The specific instructions for how the trust assets should be managed and distributed, including any conditions that must be met by the beneficiaries.

- Revocation: The ability of the grantor to make changes or terminate the trust during their lifetime.

- Successor trustee: The person or institution designated to take over management of the trust if the initial trustee is no longer able to do so.

LegalSimpli’s Revocable Living Trust template includes all of those components to help you avoid probate, maintain privacy, and provide for loved ones after death.

What are the Advantages of using a Revocable Living Trust fillable template?

Creating a Revocable Living Trust is a crucial step in ensuring that your wishes are carried out in the event of your incapacitation or death. With LegalSimpli, the process of creating a Revocable Living Trust has never been easier.

One of the most significant advantages of using a Revocable Living Trust template is the cost savings. Creating a trust from scratch can be a costly affair, as you would need to hire a lawyer to draft the document for you. However, with the availability of free printable Revocable Living Trust templates, you can save on legal fees and still create a legally binding document that meets your needs. Additionally, fillable templates provide an efficient way to create your trust as they guide you through the process and ensure that you don’t miss any important details.

And the benefits don’t stop once you have created your first Revocable Living Trust. To make sure this is truly a living document, you can keep your trust stored in LegalSimpli’s online database and constantly update and tweak your document as your situation changes. Tailor your trust to fit your unique circumstances and estate planning goals, save the document, and refer back to it whenever you need to restructure your living trust.

Consequences of not Having an Revocable Living Trust

If you do not have a valid Revocable Living Trust, your assets will have to go through probate. Probate is a court process that can be time-consuming, expensive, and stressful for your family. It can take months or even years to complete, and during that time, your loved ones may not have access to the assets they need to pay bills or cover living expenses.

Additionally, if you do not have a Revocable Living Trust, your estate may be subject to estate taxes. Estate taxes can be a significant burden on your loved ones and can reduce the amount of money they inherit. By creating a Revocable Living Trust, you can help ensure that your assets are distributed according to your wishes and that your loved ones are taken care of after you are gone.

With LegalSimpli’s free Revocable Living Trust templates, there is no reason not to take advantage of the benefits of a Revocable Living Trust.

Short on Time?

Read the Highlights:

A Revocable Living Trust is a legal document that enables you to manage your assets while you are alive and distribute them after your death. It offers a flexible and customizable way to manage your estate planning needs, ensuring that your assets are distributed according to your wishes.

LegalSimpli’s Revocable Living Trust templates are the simplest way to arm yourself with a legally binding Revocable Trust. Our templates can be customized to fit your specific needs and can include provisions for managing your assets during your lifetime, as well as for distributing them after your death.

Not having a Revocable Living Trust will slow down the process of sharing your wealth after you pass away. Your assets may go through probate, which can be lengthy and expensive. Furthermore, without a trust in place, the court could decide how to distribute your assets according to state laws, rather than your wishes.